Toronto, Ontario–(Newsfile Corp. – September 3, 2020) – Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the “Company” or “Appia”) is pleased to announce the assay surface sample results from the recently completed Phase I exploration program (the “Program“) on the Alces Lake high-grade rare earth element (“REE“) property (the “Property“), northern Saskatchewan. See news release dated August 6, 2020, for a summary of the surface prospecting results.

Surface sample assay highlights include;

Ermacre: 4.209 wt% total rare earth oxide (“TREO“) and 0.012 wt% gallium oxide (“Ga2O3“) from an outcrop grab sample

Oldman (Line 2): 1.117 wt% TREO and 0.011 wt% Ga2O3 over 4.69 m channel sample length, including 2.609 wt% TREO over 1.67 m

Ken: 0.591 wt% TREO from an outcrop grab sample

Hawker: 0.171 wt% uranium oxide (U3O8) from an outcrop grab sample.

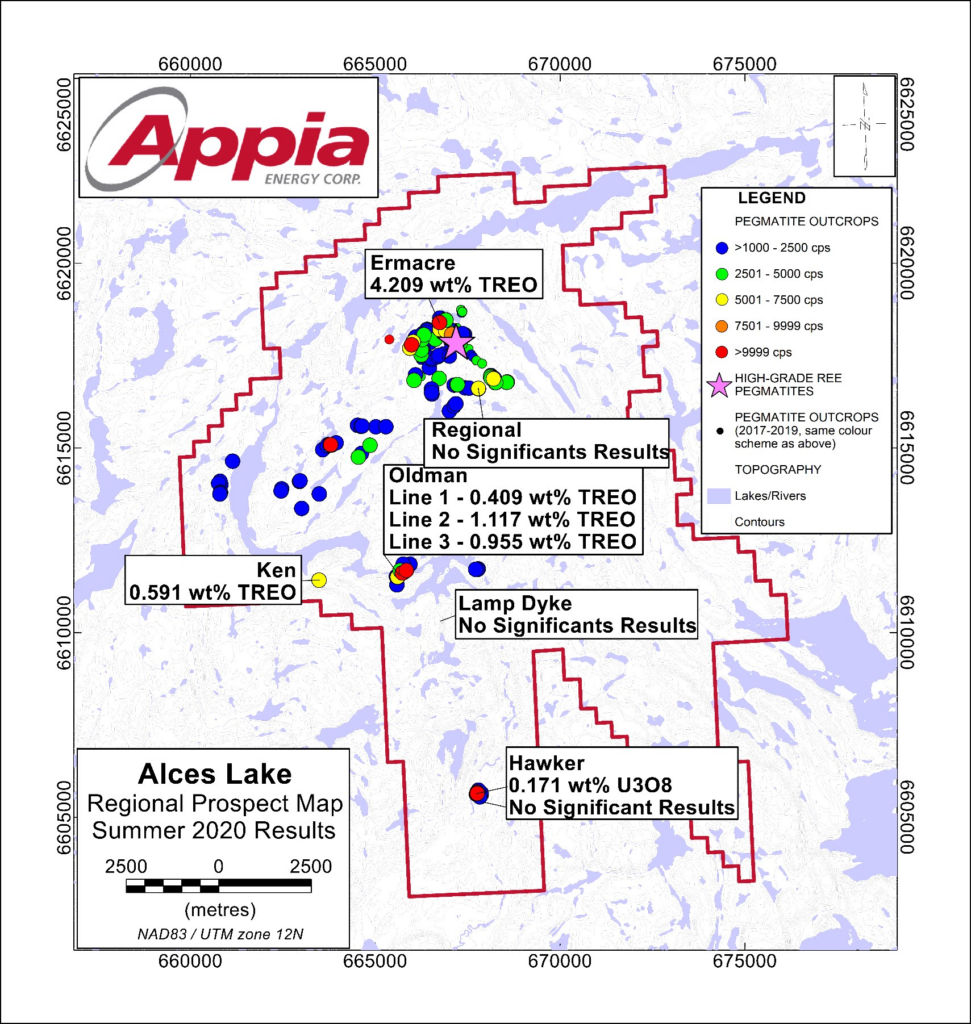

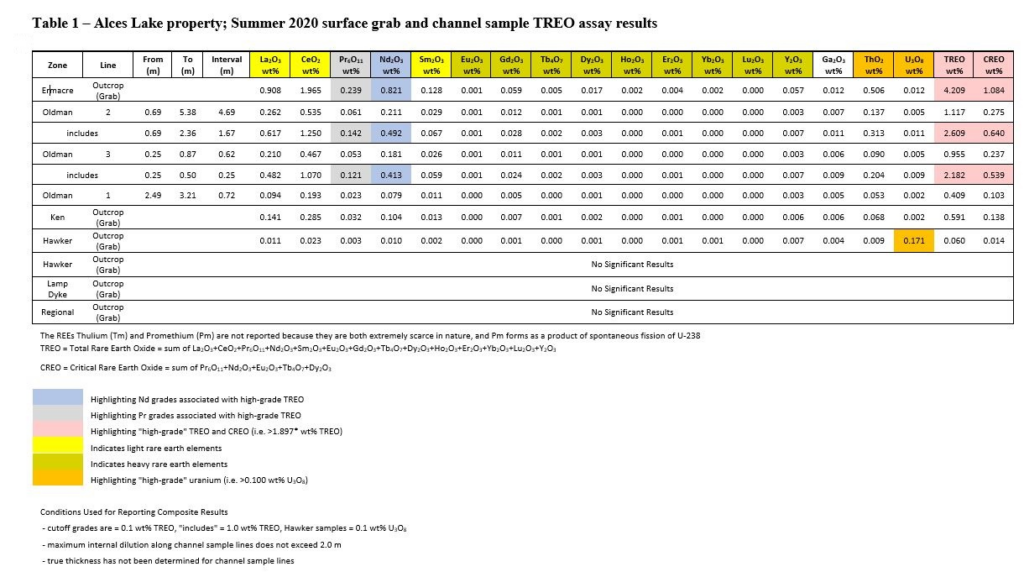

See Table 1 for a summary of results from all 24 samples collected during the Program. Figure 1 provides an overview for the sample locations.

Mr. James Sykes, Vice-President, Exploration and Development, comments: “Having confirmed our recently discovered showings, Ermacre and Oldman, as high-grade REE surface exposures is very exciting for us. Ermacre, which is located 600 m NW of the Charles zone(s), now represents the most northern occurrence of high-grade REE mineralization exposed at surface on the Property. We will continue Phase II exploration (diamond drilling) along the Ermacre-Hinge to Charles-Wilson corridor in search for continuity of the REE minerals system (the “System“) and additional high-grade REE zones. The Oldman and Ken occurrences, 6.5 and 7.5 km SW of the Charles-Wilson zones, clearly demonstrate the extent to which the System can occur along our Property’s 40 km-long geological trend. The confirmation of high-grades at Hawker is very encouraging. The historic Hawker workings will be targeted further in order to maximize the Company’s potential for both REE and uranium”.

The Ermacre zone assay results are unique because of their enrichment in heavy REE, such as dysprosium (Dy) and terbium (Tb), when compared with the other samples. The Biotite Lake discovery (see News Release – November 20, 2019) shares a similarly enriched heavy-to-light REE ratio with the Ermacre zone when compared with other Alces Lake surface zones, suggesting that the two zones might be part of another REE System.

High-grade gallium (defined here as >0.010 wt% Ga2O3) has also been noted at both the Ermacre and Oldman zones. The gallium concentrations here are similar to previously reported gallium results (see News Release – January 23, 2020), suggesting that gallium concentration is possibly tied to the System across the Property.

ALCES LAKE

Since detailed exploration began at Alces Lake in 2017, a total of seventy-four (74) REE and uraniumbearing surface zones* and occurrences* of the REE and U minerals system(s) (the “Minerals System”) have been discovered on the Property. To date, less than 15% of the Property surface has been explored on the ground. Surface channel and diamond drill samples from within six zones (Bell, Charles, Dante, Dylan, Ivan, Wilson) return an average composite grade of 16.65 wt% TREO (see Table 1). The Ivan zone, in particular, hosts some of the highest grades observed on the Property. Surface mineralization from the Ivan zone returned up to 53.01 wt% TREO over 1.97 m, or ~85% monazite, i.e., the mineral hosting the REE. Diamond drill hole IV-19-012 intersected 16.06 wt% TREO over 15.55 m, including 49.17 wt% TREO over 3.70 m. Critical elements required for rare earth magnets (neodymium, praseodymium, dysprosium and terbium) account for between 23% and 25% of the TREO. Rare earth magnets are used in a wide range of modern technological applications. Hence, the rare earth magnet industry is projected to grow rapidly over the next 30 years in-line with the adoption of electric vehicles and wind turbines, in particular. The Minerals System has been discovered as far as 12 km away from the Company’s previous areas of diamond drilling, and the cumulative showings represent approximately 10 km of a 45 km-long regional strike length. The scale and high-number of surface discoveries suggests the Minerals System is widespread at surface, but it is not readily detectable by eye or other surface geophysical methods due to overburden cover. The Company believes that the Minerals System is even more connected, widespread, and voluminous beneath the surface

The Property encompasses some of the highest-grade total and critical rare earth elements (“CREE“) mineralization in the world. CREE is defined here as those rare earth elements that are in short-supply and high-demand for use in permanent magnets and modern electronic applications such as electric vehicles and wind turbines, (i.e: neodymium (Nd), praseodymium (Pr) dysprosium (Dy), and terbium (Tb)). The Alces Lake project area is 17,577 hectares (43,434 acres) in size, and is 100% owned by Appia. The project is located close to an old mining camp with existing support services, such as transportation (i.e., 15 km from the nearest trail), energy infrastructure (hydroelectric power), a 1,200 m airstrip that receives daily scheduled services, and access to heavy equipment. The project is also located in Saskatchewan, the same provincial jurisdiction as a planned “first-of-its-kind” rare earth processing facility in Canada, which is scheduled to become operational by 2022.

Phase 2 of the 2020 summer exploration program comprises:

– 2,000 to 3,000 m of diamond drilling following the strike extension of the Wilson, Charles and Ivan zones, and reconnaissance drilling on select regional geological and geophysical targets of interest;

– additional regional ground prospecting, mapping and sampling over areas of interest

– excavated overburden removal and outcrop washing

Non-Brokered Flow-Through Private Placement

The Company is also pleased to announce the offering of a non-brokered private placement of up to 4,000,000 flow-through units (the “FT Units“) at $0.25 or up to 4,000,000 working capital units (the “WC Units“) at $0.20 or a combination thereof to a maximum of 4,000,000 units (the “Offering“).

Each FT Unit is priced at $0.25 and consists of one (1) common share and one-half (0.5) of a share purchase warrant. Each full warrant (“Warrant”) entitles the holder to purchase one (1) common share (a “Warrant Share“) at a price of $0.35 per Warrant Share until eighteen (18) months from closing.

Each WC Unit is priced at $0.20 and consists of one (1) common share and one-half (0.5) of a share purchase warrant. Each full warrant (“Warrant”) entitles the holder to purchase one (1) common share (a “Warrant Share“) at a price of $0.30 per Warrant Share until eighteen (18) months from closing.

Proceeds from the Offering are expected to be used for exploration of the Company’s uranium and rare earth element properties in Saskatchewan.

All securities to be issued under the Offering will be subject to a statutory four month hold period.

Three (3) insiders of the Company will subscribe for a total of 670,000 FT Units for $167,500 of the Offering and 200,000 WC Units for $40,000. The insider private placements are exempt from the valuation and minority shareholder approval requirements of Multilateral Instrument 61-101 (“MI 61-101“) by virtue of the exemptions contain in section 5.5(a) and 5.7(1) (a) of MI 61-101 in that the fair market value of the consideration for the securities of the Company to be issue to the insiders does not exceed 25% of its market capitalization.

The Company anticipates closing on the arm’s length portion of the Offering of 2,680,000 FT Units for $670,000 and 450,000 WC Units for $90,000 next week.

All assay results were provided by Saskatchewan Research Council’s (“SRC“) Geoanalytical Laboratory, an ISO/IEC 17025:2005 (CAN-P-4E) certified laboratory in Saskatoon, SK, for multi-element and REE analysis.

All analytical results reported herein have passed rigorous internal QAQC review and compilation. The technical content in this news release was reviewed and approved by Dr. Irvine R. Annesley, P.Geo, Advisor to Appia’s Board of Directors, and a Qualified Person as defined by National Instrument 43-101.

About Appia

Appia is a Canadian publicly-listed company in the uranium and rare earth element sectors. The Company is currently focusing on delineating high-grade critical rare earth elements (“REE”) and uranium on the Alces Lake property, as well as prospecting for high-grade uranium in the prolific Athabasca Basin on its Loranger, North Wollaston, and Eastside properties. The Company holds the surface rights to exploration for 65,601 hectares (162,104 acres) in Saskatchewan.

The Company also has a 100% interest (subject to a 1% Uranium Production Payment Royalty and a 1% Net Smelter Return Royalty on any precious or base metals payable, provided that the price of uranium is greater than US$130 per pound) in 12,545 hectares (31,000 acres), with rare earth element and uranium deposits over five mineralized zones in the Elliot Lake Camp, Ontario. The Camp historically produced over 300 million pounds of U3O8 and is the only Canadian camp that has had significant rare earth element (yttrium) production. The deposits are largely unconstrained along strike and down dip.

Appia’s technical team is directed by James Sykes, who has had direct and indirect involvement with over 550 million lbs. U3O8 being discovered in five deposits in the Athabasca Basin.

Appia has 73.9 million common shares outstanding, 89.9 million shares fully diluted.

For more information, visit the Appia’s website at www.appiaenergy.ca.

Cautionary Note Regarding Forward-Looking Statements: This News Release contains forward-looking statements which are typically preceded by, followed by or including the words “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans” or similar expressions. Forward-looking statements are not guarantees of future performance as they involve risks, uncertainties and assumptions. We do not intend and do not assume any obligation to update these forward- looking statements and shareholders are cautioned not to put undue reliance on such statements.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Tom Drivas, President, CEO and Director: (tel) 416-546-2707, (fax) 416-218-9772 or (email) appia@appiaenergy.ca

James Sykes, VP Exploration & Development, (tel) 306-221-8717, (fax) 416-218-9772 or (email) jsykes@uraniumgeologist.com

Frank van de Water, Chief Financial Officer and Director, (tel) 416-546-2707, (fax) 416-218-9772 or (email) fvandewater@rogers.com

Figure 1 – Alces Lake property; Summer 2020 surface assay results

Table 1 – Alces Lake property; Summer 2020 surface grab and channel sample TREO assay results