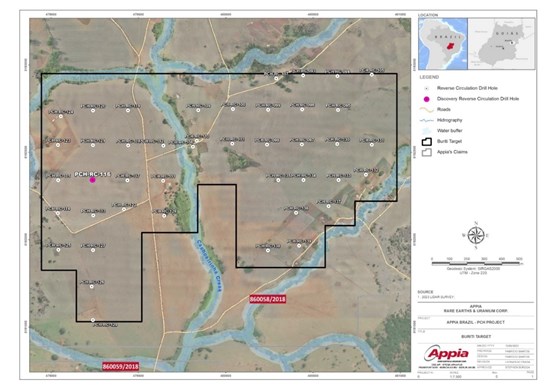

TORONTO, ONTARIO, December 12th, 2023, – Appia Rare Earths & Uranium Corp. (the “Company” or “Appia”) (CSE: API) (OTCQX: APAAF) (Germany: “A0I0.F”, “A0I0.MU”, “A0I0.BE”) is pleased to announce the discovery of a new mineralized zone named BURITI, showcasing mineralization of Scandium (Sc), Cobalt (Co) and Rare Earth Elements (REE) in Reverse Circulation (RC) hole PCH-RC-116. This newly identified mineralized BURITI Target, located within the weathered profile southward from the current area of interest, was revealed through exploratory RC and Auger drilling conducted as part of the ongoing 2023 drill program. Of the 300-hole drill campaign, 47 holes were executed within the newly defined Buriti Target Zone.

“This discovery opens the potential of a promising new target zone for exploration and development, and represents the first time that we have intersected significant continuous levels of Scandium Oxide (Sc2O3), Cobalt Oxide (CoO), and Rare Earth Oxides (REO) mineralization in the same RC drill hole,” stated Tom Drivas, CEO of Appia. He continued, “PCH-RC-116’s average grade of 128 ppm Sc203, 272 ppm CoO, and 2,106 ppm TREO across 24 metres from surface represents an especially important new exploration target for the Company.”

Highlights:

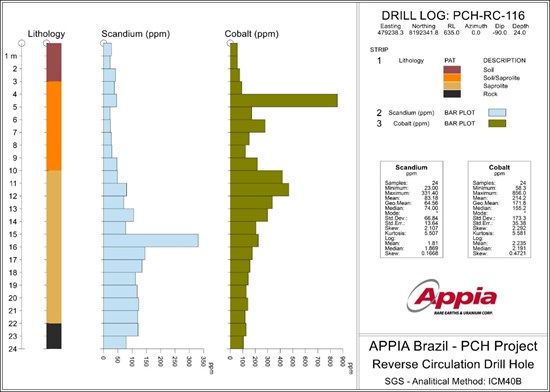

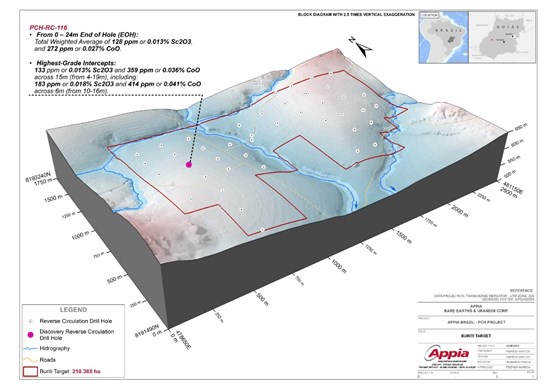

- PCH-RC-116 from 0 – 24m End of Hole (EOH):

- Total Weighted Average of 128 Parts Per Million (ppm) or 0.013% Sc2O3, 272 ppm or 0.027% CoO, and 2,106 ppm or 0.21% of Total Rare Earth Oxides (TREO).

- Highest-Grade Intercepts:

- 133 ppm or 0.013% Sc2O3, 359 ppm or 0.036% CoO, and 2,461 ppm or 0.24% TREO across 15m (from 4-19m), including:

- 183 ppm or 0.018% Sc2O3, 414ppm or 0.041% CoO, and 2,401 ppm or 0.24% TREO across 6m (from 10-16m).

- 133 ppm or 0.013% Sc2O3, 359 ppm or 0.036% CoO, and 2,461 ppm or 0.24% TREO across 15m (from 4-19m), including:

“These are valuable elements, identifying a mineralized zone with this range of grades that remains open at depth introduces a new layer of potential value to our PCH project,” Stated Stephen Burega, President. “Appia will be conducting a thorough investigation into the extent of this significant discovery, and analytical results for the 46 pending RC and Auger drill holes from this mineralized zone will be reported once received. Metallurgical testing is planned to confirm the economic potential of the Buriti Target.”

The Buriti Target is hosted within mafic and ultramafic rock formations associated with the Tertiary-age regional alkaline complex. Despite the proximity of Target IV, where the lithology consists of granites and alkali breccias, this new target is predominantly underlain bygabbro, diorite and pyroxenite. “The high-grade intervals identified within the weathering profile, specifically in the saprolite layer, represent a supergene concentration of scandium and cobalt together with REEs within these mafic rocks,” commented Carlos Bastos, Geology Manager and Brazilian Qualified Person (QP).

Leo Fraga, Senior Geologist, observed, “The presence of consistently higher-gradeREE values throughout the entire hole PCH-RC-116 is very encouraging. The hole remains open at depth, showing a 20-metre interval with 2,421 ppm TREO, and 454 ppm Magnet Rare Earth Oxides (MREO) constituting 20% of the total TREO from 4m to 24m (EOH).”

Recent market analysis indicates that the demand for Scandium reached approximately USD 15 billion in 2022 and forecasts indicate a significant increase in this figure is expected as Scandium appears on most Critical Metals lists globally. Despite a fairly common but distributed occurrence, scandium rarely concentrates in nature, making commercial grade stand-alone resources quite unusual. The most significant forward-looking market opportunity for scandium is as an alloying agent for aluminum. When applied as an addition to certain standard aluminum alloys, scandium can produce stronger, more corrosion resistant, more heat tolerant, weldable aluminum products. This strong resistance to extreme heat that makes scandium oxide important in various applications, including high-temperature systems, electronic ceramics, aerospace alloys, and glass manufacturing. Scandium is currently trading in a substantial +/-$1000 USD per kg range.

The Company has achieved a milestone of 300 combined drill holes and is committed to keeping investors informed of the project results. Timely updates will be provided as assay results are obtained from the remaining 3 RC, 77 auger drill holes, which are located both within Target IV and various extension zones including the newly defined Buriti Zone. The Company has an ongoing auger drilling program across the entire PCH property to identify additional target zones, which further underscores our commitment to thorough exploration beyond the established Target IV and Buriti Target areas.

| REVERSE CIRCULATION HOLE PCH-RC-116 (ASSAY IN PPM, BY SGS LAB) | ||||

| Total depth | 2 – 5m | 9-24m | 15-20m | 0 – 24m (EOH) |

| TREO | 889.2 | 2,739.3 | 4,408.3 | 2,106.3 |

| MREO | 117.3 | 511.8 | 652.5 | 393.7 |

| HREO | 46.0 | 170.5 | 192.6 | 136.6 |

| LREO | 843.2 | 2,568.9 | 4,215.7 | 1,969.7 |

| Sc2O3 | 64.2 | 175.5 | 258.2 | 127.6 |

| CoO | 434.1 | 277.4 | 211.9 | 272.3 |

| Magnet -MREO | ||||

| Total depth | 2 – 5m | 9-24m | 15-20m | 0 – 24m (EOH) |

| Nd2O3 | 73.8 | 323.6 | 414.6 | 248.2 |

| Pr2O3 | 20.9 | 103.4 | 143.3 | 77.9 |

| Sm2O3 | 13.9 | 50.3 | 56.0 | 39.9 |

| Dy2O3 | 7.4 | 29.1 | 32.7 | 23.4 |

| TbO3 | 1.4 | 5.4 | 6.0 | 4.3 |

| MREO | 117.3 | 511.8 | 652.5 | 393.7 |

| Heavy – HREO | ||||

| Total depth | 2 – 5m | 9-24m | 15-20m | 0 – 24m (EOH) |

| Sm2O3 | 13.9 | 50.3 | 56.0 | 39.9 |

| Eu2O3 | 3.3 | 13.8 | 15.3 | 10.8 |

| Gd2O3 | 10.2 | 41.8 | 47.2 | 32.9 |

| TbO3 | 1.4 | 5.4 | 6.0 | 4.3 |

| Dy2O3 | 7.4 | 29.1 | 32.7 | 23.4 |

| Ho2O3 | 1.4 | 4.9 | 5.7 | 4.0 |

| Er2O3 | 3.7 | 12.9 | 15.3 | 10.6 |

| Tm2O3 | 0.5 | 1.5 | 1.8 | 1.3 |

| Yb2O3 | 3.7 | 9.4 | 11.1 | 8.2 |

| Lu2O3 | 0.5 | 1.3 | 1.5 | 1.1 |

| HREO | 46.0 | 170.5 | 192.6 | 136.6 |

| Light -LREO | ||||

| Total depth | 2 – 5m | 9-24m | 15-20m | 0 – 24m (EOH) |

| La2O3 | 110.8 | 999.5 | 1,692.0 | 703.3 |

| CeO2 | 637.8 | 1,142.4 | 1,965.8 | 940.3 |

| Pr2O3 | 20.9 | 103.4 | 143.3 | 77.9 |

| Nd2O3 | 73.8 | 323.6 | 414.6 | 248.2 |

| LREO | 843.2 | 2,568.9 | 4,215.7 | 1,969.7 |

Table #1 – Denotes weighted average chemical assay results of composites RC and Auger samples from PCH-RC-116. For full assay results please click here for RC.

Figure #1 – Dill log of RC hole PCH-RC-116.

Map #1 – Map of RC drill locations at the Buriti Traget, PCH Project, Brazil.

Map #2 – An isometric view of the Buriti Target and location of PCH-RC-116.

| HOLE_ID | UTM E | UTM N | Elevation | Final Length (m) |

| PCH-RC-116 | 479238.3 | 8192341.8 | 636.5 | 24 |

Table #2. PCH-RC-116 collar details – SIRGAS 2000 – UTM zone 22S.

Background on the PCH Project

The PCH Project is located within the Tocantins Structural Province in the Brasília Fold Belt, more specifically, the Arenópolis Magmatic Arc. The PCH Project is 17,551.07 ha in size and located within the Goiás State of Brazil. It is classified as an alkaline intrusive rock occurrence with highly anomalous REE and Niobium mineralization. This mineralization is related to alkaline lithologies of the Fazenda Buriti Plutonic Complex and the hydrothermal and surface alteration products of this complex by supergene enrichment in a tropical climate. The positive results of the recent geochemical exploration work carried out to date indicates the potential for REEs, niobium (Nb), scandium (Sc) and cobalt (Co) within lateritic ionic adsorption clays.

The technical content in this news release was reviewed and approved by Mr. Don Hains, P.Geo, Consulting Geologist, and a Qualified Person as defined by National Instrument 43-101.

QA/QC

Reverse circulation (RC) drill holes are vertical and reported intervals are true widths. Each are sampled at one metre intervals, resulting in average sample sizes of 5-25 kg. A small representative specimen was taken from each sample bag and placed into a chip tray for visual inspection and logging by the geologist. Quartering was performed at Appia’s logging facility using a riffle splitter and continued splitting until a representative sample weighing approximately 500g each was obtained, bagged in a resistant plastic bag, labeled, photographed, and stored for shipment.

The samples were sent to the SGS laboratory in Vespasiano, Minas Gerais. In addition to the internal QA/QC of the SGS Lab, Appia has used its own control samples in each batch sent to the laboratory.

Quality control samples, such as blanks, duplicates, and standards (CRM) were inserted into each analytical run. For all analysis methods, the minimum number of QA/QC samples is one standard, one duplicate and one blank, introduced every batch which comprise a full-length hole. The rigorous procedures implemented during the sample collection, preparation, and analysis stages underscore the robustness and reliability of the analytical results obtained.

All analytical results reported herein have passed internal QA/QC review and compilation. All assay results of RC samples were provided by SGS Geosol, an ISO/IEC 17025:2005 certified laboratory, which performed their measure of the concentration of rare earth elements (REE) analyses by Inductively Coupled Plasma Mass Spectrometry (ICP-MS) analytical methods.

The technical content in this news release was reviewed and approved by Mr. Don Hains, P.Geo, Consulting Geologist, and a Qualified Person as defined by National Instrument 43-101.

About Appia Rare Earths & Uranium Corp. (Appia)

Appia is a publicly traded Canadian company in the rare earth element and uranium sectors. The Company is currently focusing on delineating high-grade critical rare earth elements and gallium on the Alces Lake property, as well as exploring for high-grade uranium in the prolific Athabasca Basin on its Otherside, Loranger, North Wollaston, and Eastside properties. The Company holds the surface rights to exploration for 113,837.15 hectares (281,297.72 acres) in Saskatchewan. The Company also has a 100% interest in 12,545 hectares (31,000 acres), with rare earth element and uranium deposits over five mineralized zones in the Elliot Lake Camp, Ontario. Lastly, the Company holds the right to acquire up to a 70% interest in the PCH Project which is 17,551.07 ha. in size and located within the Goiás State of Brazil. (See June 9th, 2023 Press Release – Click Here)

Appia has 130.5 million common shares outstanding, 139.0 million shares fully diluted.

Cautionary Note Regarding Forward-Looking Statements: This News Release contains forward-looking statements which are typically preceded by, followed by or including the words “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans” or similar expressions. Forward-looking statements are not a guarantee of future performance as they involve risks, uncertainties and assumptions. We do not intend and do not assume any obligation to update these forward- looking statements and shareholders are cautioned not to put undue reliance on such statements.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Tom Drivas, CEO and Director: (cell) 416-876-3957, (fax) 416-218-9772 or (email) tdrivas@appiareu.com

Stephen Burega, President: (cell) 647-515-3734 or (email) sburega@appiareu.com